Green Farms Nut Company, one of South Africa’s largest macadamia processors, is swiftly adapting its strategy in response to the 30% tariff on South African macadamia kernel exports to the United States. Leveraging its international supply base and commercial partnerships, the company is redirecting volumes and strengthening its presence in key markets across Asia and Europe.

Alex Whyte, executive at Green Farms Nut Company, acknowledged the shift but maintained a confident outlook. “While the US has historically been a core market, the fundamentals of global demand haven’t changed. Macadamias remain a sought-after product, and we’re already seeing solid traction in other regions where quality and consistency are valued,” he said.

Through its international marketing arm, Green and Gold Macadamias, the company is actively growing its market share in Asia and Europe. The ability to respond nimbly to changing market conditions without compromising product quality or customer service is secured by longstanding supply partnerships with producers in Australia, Brazil, and East Africa.

Strategic shift to Asia and Europe

“Markets like Japan, Germany, and the Netherlands are showing strong appetite for kernel. By drawing on our global sourcing capabilities, we can ensure supply continuity even in the face of trade challenges,” Whyte said.

He noted that while the US tariff poses short-term challenges, the broader outlook for the macadamia kernel remains positive. As an ingredient used in food manufacturing, kernel is not easily substituted, making product consistency and long-term supply relationships especially important.

Related stories

- Unlock the secrets to growing nutritious peanuts

- Siphelele cracks success code in macadamia farming

- Grain and oilseed markets: Tariffs shake up global trade

- US tariffs add pressure as global markets face rising uncertainty

Building resilience in global trade

According to Whyte, Green Farms Nut Company remains in a stable position, with no carryover stock from the previous season and most 2025 forward volumes already sold.

In addition to commercial redirection, the company is actively working with South African industry bodies and government partners to support long-term diversification and resilience in the face of global trade shifts.

“Agility, innovation, and global collaboration are at the heart of how we operate. This isn’t the first disruption we’ve faced, and it won’t be the last, but we’re built for exactly this kind of environment,” Whyte said.

Agbiz chief economist Wandile Sihlobo highlighted the significance of China as a growing destination for South African agricultural exports.

“In recent years, China has steadily increased imports from South Africa. Take agriculture as an example: today, as avocados and dairy products have gained market access to China, 68 categories of South African agri-food products can be exported to China. 90% of South Africa’s pecans and half of its macadamias are sold to China.

“These products have enriched the food baskets of Chinese consumers, and more importantly, increased the incomes of South African farmers and exporters,” he said.

Sihlobo added that while this momentum is encouraging and deeper integration of agricultural products into China is welcome, certain barriers remain. Many of the products still face tariffs, with macadamia nuts, for example, carrying a 12% tariff in China.

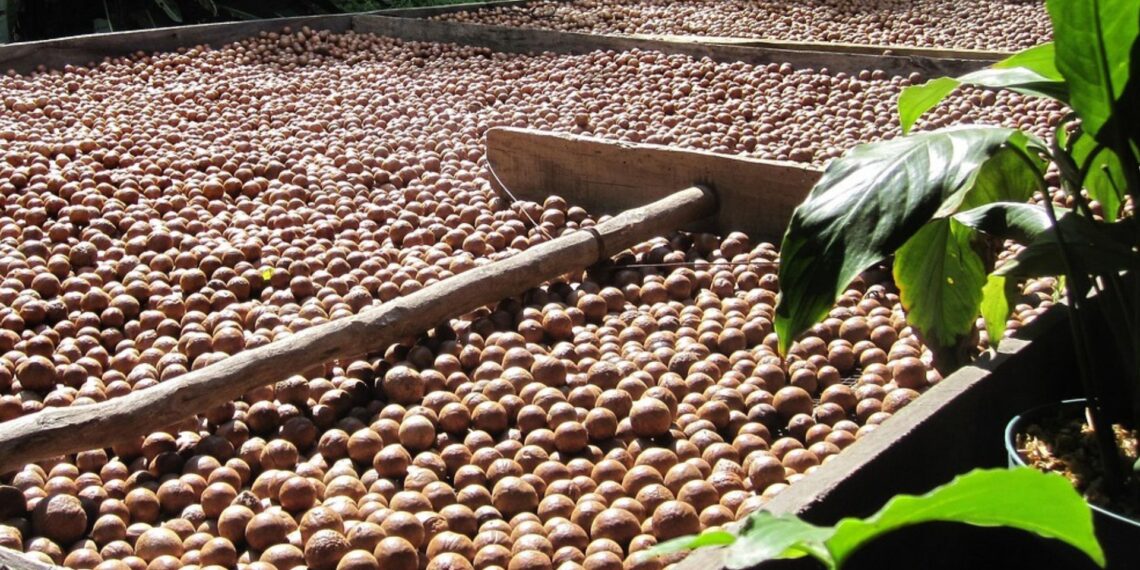

Market demand for macadamia

Shifting focus to the local market, Love Macadamia, the global movement powered by the World Macadamia Organisation (WMO), aims to inspire consumers to enjoy macadamias in everyday cooking and entertaining.

Jillian Laing, CEO of the WMO, said, “Macadamias and macadamia oil are nature’s gift to both cooks and entertainers. Their delicate crunch and buttery taste, along with the smooth richness of the oil, elevate even the simplest dishes, while their healthy fats and natural goodness make them a smart choice for any occasion,” he said.

READ NEXT: Indigenous flowers: A new path to profit for SA farmers